Pak's Sharif govt can take difficult methods to safe $6.5 billion stalled IMF resources | World News

[ad_1]

(*7*)(*6*)

Pak's Sharif govt can take difficult methods to safe $6.5 billion stalled IMF resources | World News

[ad_1]

(*7*)(*6*)

Pakistan’s moves to loosen its grip on the forex and raise gas selling prices show that the beleaguered country is eventually having the unpopular choices necessary to safe the $6.5 billion bailout software from the Intercontinental Financial Fund.

The rupee fell to as lower as 270 for every greenback on Monday, in accordance to the overseas-trade desk at AKD Securities Ltd., as authorities authorized the forex to be much more identified by the current market, a single of the preconditions of the IMF for the bank loan. The governing administration also greater gasoline selling prices to document in excess of the weekend, in advance of the arrival of the IMF staff on Tuesday for a bank loan assessment following months of hold off in excess of the upcoming bank loan tranche.

Also Study: ‘We require peace…’: Pak cricketers condemn Peshawar blast

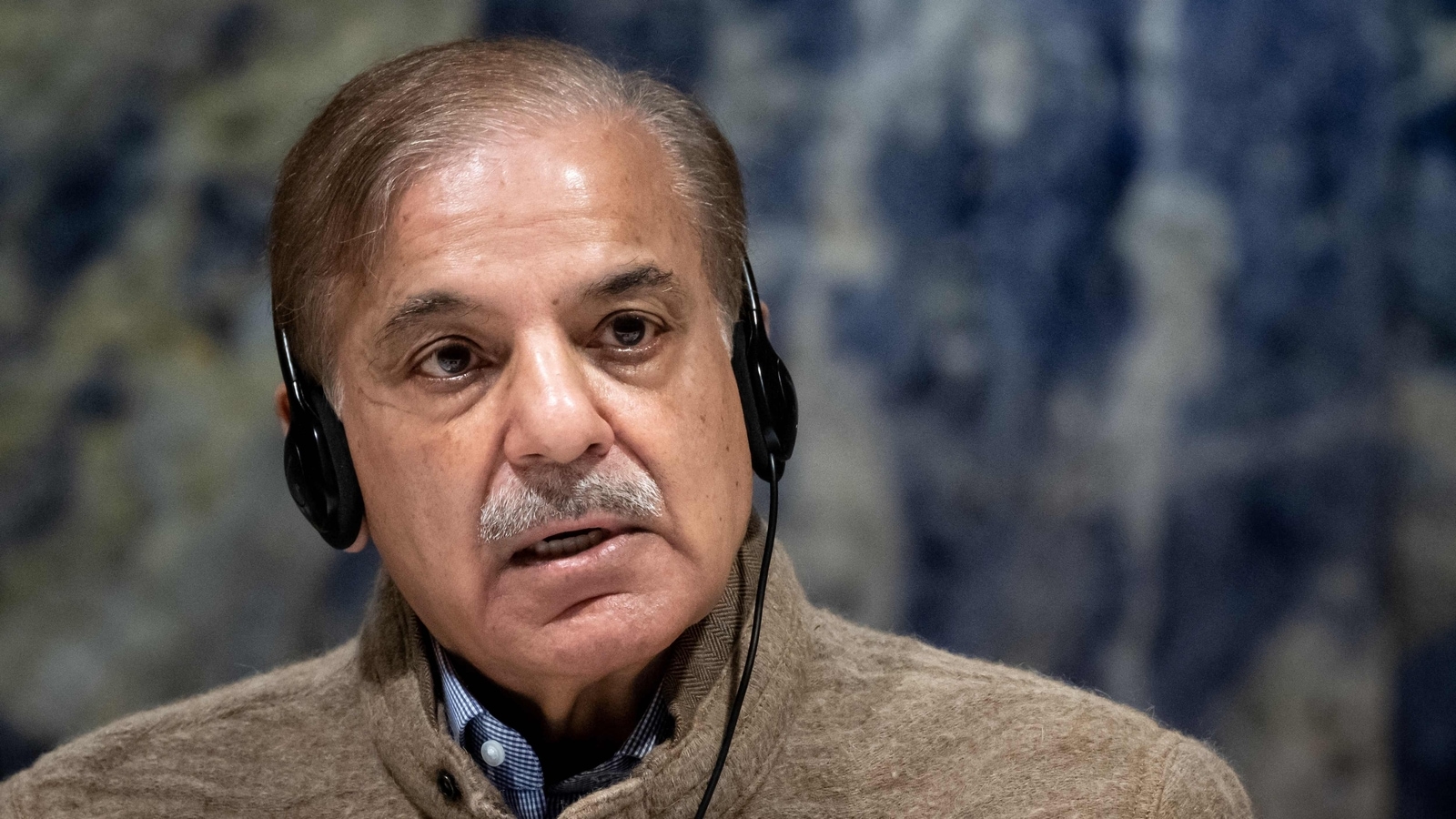

Pakistan is spiraling further into disaster amid a lack of bucks and accelerating inflation, rising the urgency for Key Minister Shehbaz Sharif to safe resources from the IMF. The region direly desires resources as its reserves dropped to $3.7 billion, considerably less than a single thirty day period of import include.

“Pakistan has gotten critical about the IMF software by having these choices even even though we are in an election yr,” explained Suleman Rafiq Maniya, head of advisory at Vector Securities Pvt. “All is dependent on the IMF staff go to and their response. These actions are rather agonizing and have a massive political value.”

Also Study: Pakistan's politico-financial disaster could gas instability in location: Authorities

Pakistan’s Forex Shock Is Little one Move Towards IMF Financial loan Revival

Sharif has explained his coalition governing administration is identified to finish the bailout program following a hold off in employing crucial choices, even even though it signifies paying out a political value just months absent from countrywide elections. A difficult activity lies in advance for the nation’s financial supervisors led by Finance Minister Ishaq Dar, who will require to influence the IMF that the region is completely ready to put into action other difficult actions, such as boosting taxes and fuel selling prices.

Frontier marketplaces looking for IMF funding are dealing with increased strain to loosen their grip on currencies, which will assist increase their existing-account balances. Egypt this thirty day period experienced its 3rd devaluation in considerably less than a yr. Calculations by Bloomberg Economics demonstrate the rupee really should stabilize at 266 for every greenback, in accordance to a take note Monday by Ankur Shukla, an analyst in Mumbai.

In Pakistan, the rupee’s slide this thirty day period was brought on by the determination of dollars trade firms to abolish the restrict on the greenback-rupee charge in the open up current market. Source of bucks between onshore dollars-modifying companies has dried up as locals turned to the black current market, as the buck was getting marketed at about ten% previously mentioned marketed costs.

(*3*) (*7*)(*5*)

No comments:

Post a Comment