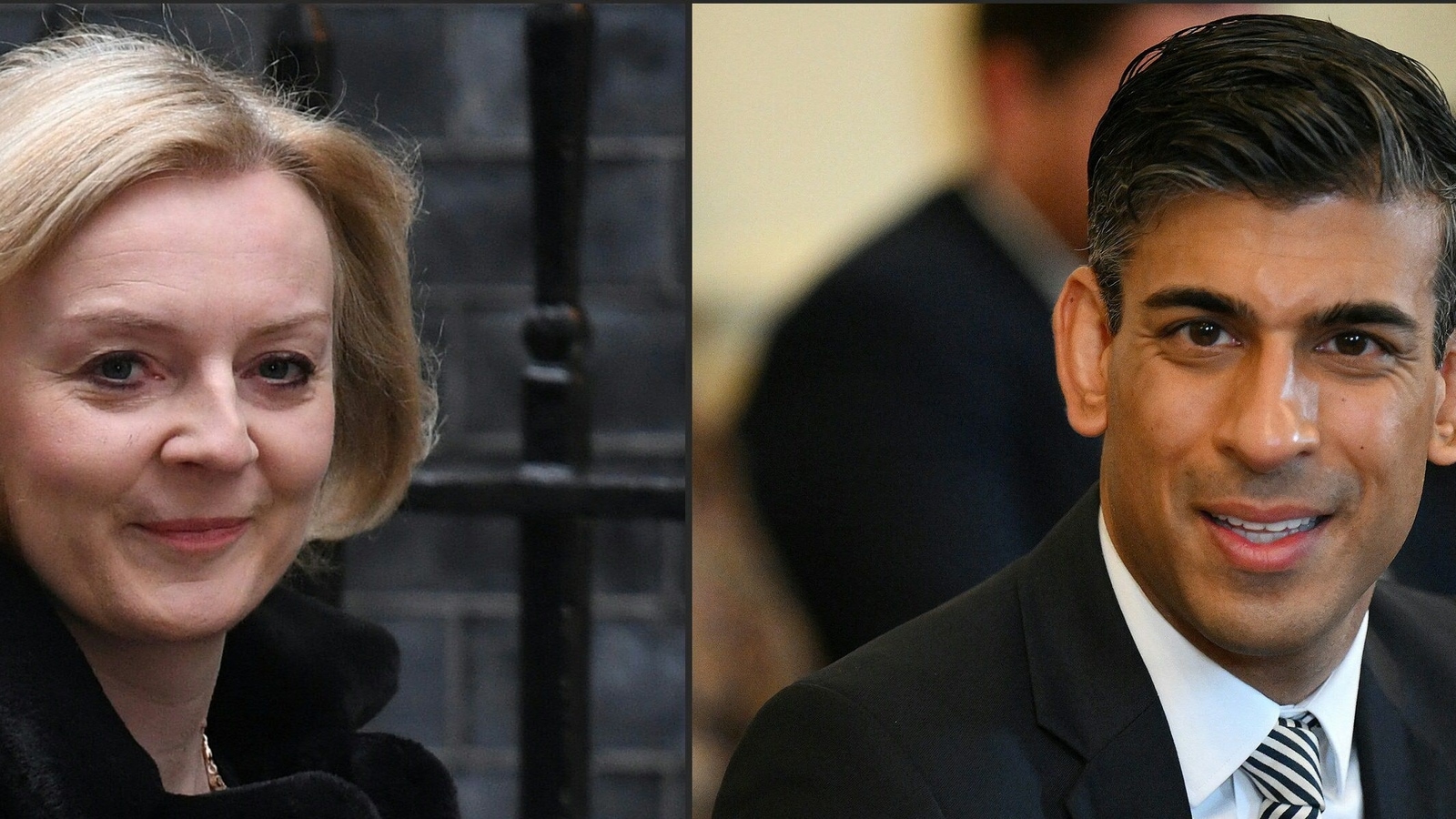

Truss vs. Sunak: The place British isles Management contenders stand on financial system | World News

[ad_1]

Truss vs. Sunak: The place British isles Management contenders stand on financial system | World News

[ad_1]

Britain’s soaring inflation charge, slowing progress and a brutal value-of-dwelling squeeze will kind the backdrop of the contest to substitute Boris Johnson as key minister.

Liz Truss and Rishi Sunak, the closing contenders in the race to guide the ruling Conservative Celebration and the country, have sharply divergent sights on how to take care of the financial system and general public funds.

Sunak, the previous chancellor of the exchequer, is the continuity applicant, standing for prudence with the general public funds. He fears that tax cuts will hold inflation significant and make the value of dwelling disaster even worse. He voted to go away the European Union.

Truss, the international secretary, is the tax-reducing financial radical who desires to supercharge progress, is concerned about a economic downturn and would assessment the Financial institution of England’s mandate. She voted to continue being in the EU.

Inflation, the value-of-dwelling disaster, tax cuts, financial reform and general public sector fork out are probable to element prominently in the discussion.

Conservative users have till Sept. 2 to vote for a applicant, with a determination because of on Sept. 5. Here’s a breakdown of the financial platforms of the two candidates:

(*2*)Rishi Sunak

As chancellor till his resignation previously this thirty day period, Sunak’s financial system is very well recognized.

He elevated payroll taxes for personnel and companies, and dragged additional staff into increased profits tax bands by freezing thresholds. For enterprise, he tabled programs to elevate company tax from 19% to twenty five% up coming 12 months.

He is sticking with the programs, which will enhance the tax stress to its best stage in 70 yrs, and has tried using to make a advantage of them.

He attacked rivals for telling “comforting fairy tales” about tax cuts, indicating borrowing additional now would guide to “higher inflation, increased house loan charges, eroded cost savings.” And he promised “responsible” tax cuts “that generate growth” after inflation is below management.

Drawing parallels with Margaret Thatcher, he pointed out that she also elevated taxes in the deal with of significant inflation and a looming economic downturn in 1981.

Like her, Sunak insists that tackling inflation ought to be his precedence. He has backed the Financial institution of England, indicating he was “worried by some of the items I’m hearing” from other candidates, who have criticized the establishment.

Even with his fiscal prudence -- he insisted on a £12 billion enhance in payroll taxes to fund wellbeing paying out -- he statements to be an instinctive Tory tax cutter.

It might show a challenging promote, while. Sunak is additional anxious about the influence of mounting desire charges and inflation on servicing the countrywide credit card debt than Truss, who voted versus his payroll tax and is pleased to borrow additional.

As chancellor, Sunak presented £37 billion of assistance for homes through the value of dwelling disaster and has claimed he would go even more if essential.

His lengthier time period strategy for progress hinges on “capital, persons, concepts.” He desires to lower taxes on enterprise expenditure and in March 2021, unveiled the largest expenditure tax split in heritage.

It was accompanied by an enhance in company tax for more substantial companies to twenty five% from 19%, nonetheless, as he tried to sharpen the incentives for companies to make investments.

Fiscal polices would be comfortable to present lengthy-time period funds for enterprise, and the Apprenticeship Levy overhauled to enhance paying out on workforce teaching.

Citing his times in Silicon Valley, Sunak desires to make the British isles financial system “the most modern in the world.” To do so, he will reform study and growth reliefs and unleash an expenditure “Big Bang” by reducing again 2,four hundred EU legal guidelines to just take edge of “Brexit freedoms.”

On fork out for general public-sector staff, Sunak thinks the most current settlements are reasonable and would not present even more funding, leaving departments to discover cost savings to fork out for the increased wages.

(*2*)Liz Truss

In distinction to Sunak, the international secretary is an financial radical. She claims intense tax cuts to improve progress on working day a single, vows to “take on Whitehall” and even reform the Financial institution of England.

“The enterprise-as-common financial approach is not daring ample for the disaster we’re in,” Truss claimed. “We’ve noticed gradual progress for a long time. We need to have to do distinct.”

She pledged to “unleash a daring strategy to reform our economy” and accused Sunak of “choking off growth” by elevating taxes and major the British isles into economic downturn.

Truss has claimed that on her 1st working day as key minister she would reverse Sunak’s enhance in payroll tax, scrap programs to increase company tax and briefly abolish inexperienced levies on power costs.

The insurance policies, a combination of instant support for battling homes and a lengthy-time period agenda for progress, would value additional than £30 billion and, in accordance to Truss, “can be compensated for in the present fiscal envelope.”

In other phrases, the income would be borrowed. Truss has argued that she would fund it by modifying the cure of £311 billion of credit card debt taken on through the pandemic. Information of the system have nevertheless to be presented.

Her spokesman claimed it would be “treated as an outstanding product to be compensated off in the lengthy term” and in contrast it to World War II credit card debt.

Britain’s war credit card debt was at reduced desire charges and compensated above fifty yrs, with the 1st installment designed 5 yrs following the credit card debt was taken. Yearly payments ended up deferred 6 occasions.

Truss’s broader progress eyesight is usually Thatcherite, marked by reduced taxes and deregulation. She has vowed to “simplify” taxes and make sure persons are not penalized for caring for youngsters or family members.

She has also warned that elevating general public sector fork out could guide to a wage selling price spiral.

She informed The Moments newspaper this 7 days that she would not carry again austerity. David Cameron’s govt from 2010 to 2015 designed “cuts to general public paying out that weren’t sustainable. I will not let that to take place,” she claimed.

Her insurance policies indicate major raises in credit card debt, which she hopes would be designed economical by significantly the speedier progress she thinks she can unleash.

Institutionally, she has also expressed a diploma radicalism. She questioned the BOE’s dealing with of inflation, vowing to assessment its mandate. She designed a cryptic reference to the Financial institution of Japan.

In accordance to her spokesman, Truss thinks that a mandate assessment is “overdue,” supplied the past a single was twenty five yrs back. He claimed a nominal GDP focus on could be regarded as. The Japanese govt released a nominal GDP focus on in 2015.

(*5*)

No comments:

Post a Comment